Mar 14, 2024

Archean Chemical Industries Limited: Surfing the Specialty Wave

Company Introduction

ACI is the leading specialty marine chemical manufacturer in India, focusing on producing and exporting bromine, industrial salt, and sulphate of potash to customers worldwide. The company holds a 60-70% market share in bromine exports and derives 49% of its revenue from bromine, with the remaining coming from industrial salt. ACI serves 27 global customers across 13 countries and 28 domestic customers, with 70% of its revenues coming from its top 10 customers.

Historical Performance

Revenue growth from ₹439 Cr in FY18 to ₹1,441 Cr in FY23, a CAGR of 27%

PAT improvement from a loss of ₹79 Cr in FY18 to a net profit of ₹384 Cr in FY23

ROCE averaging 45% in the last 3 fiscal years, highlighting efficient capital utilization

Industry Outlook

Global industrial salt market projected to expand at a CAGR of 2.8%, growing from 157 million metric tons in 2020 to 185 million metric tons by 2025

Global bromine industry, valued at approximately $3.1 billion in 2021, anticipated to grow at a CAGR of 5.8% between 2023 and 2025

India exporting bromine at higher prices compared to the cost of bromine imports, with 95% of India's bromine exports primarily to China

Key Drivers and Investment Thesis

Resurgence in Bromine Demand: ACI is experiencing a significant upturn in bromine demand, influenced by the geopolitical environment in Israel and a rise in customer inquiries

Stable Chlorine Market Dynamics: The stable demand in the chlorine market is positively impacting industrial salt volumes, ensuring a consistent revenue stream for ACI

Projected Production Timelines: ACI aims to commence production of clear brine fluid and PTA catalyst by FY24 end and launch Brominated Flame Retardants (BFR) in Q1 FY25, highlighting its strategic production expansion and innovation capabilities

Positive Outcomes from R&D in Bromine Derivatives: ACI's R&D efforts in bromine derivatives have received positive market feedback, reflecting the company's commitment to innovation and potential for growth and diversification

Financial Analysis and Valuation

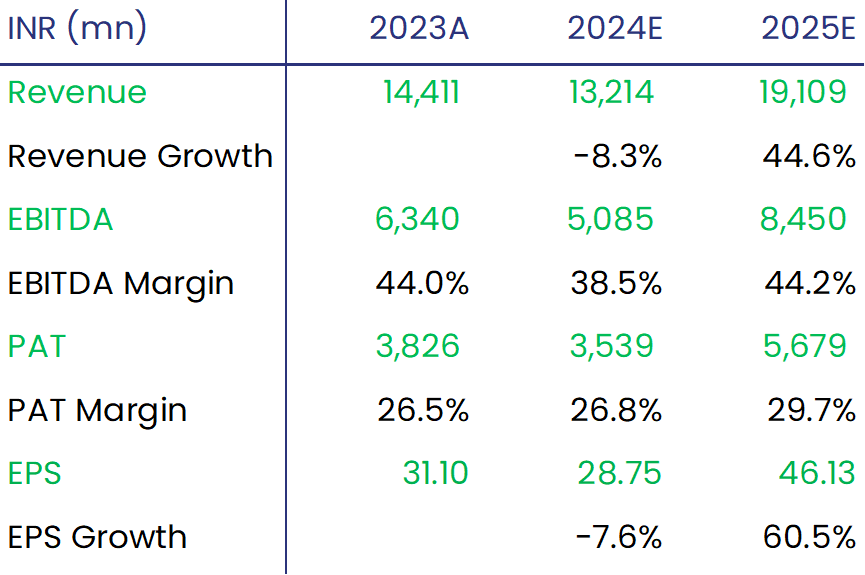

Based on our analysis, we project ACI's FY25 EPS at INR 46.13 and assign a multiple of 20x. This results in a target price of INR 922, implying a 48% upside potential within the next 12-18 months.

Recommendation

We recommend a "Buy" rating for Archean Chemical Industries Ltd, considering its strong market position, strategic initiatives, and growth prospects in the specialty marine chemicals industry. The company's focus on innovation, production expansion, and diversification, coupled with its robust financial performance, makes it an attractive investment opportunity.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.