May 7, 2024

Beating the Heat: Exploring Voltas, India's AC Mogul

Company Introduction

Voltas is India’s largest air conditioning company offering a comprehensive range of cooling & home appliances including room air conditioners, air coolers, air purifiers, refrigerators, washing machines, water dispensers, dishwashers, microwaves, and accessories in its portfolio. Voltas is the country’s largest AC brand with a market share of 21%. The company operates in over 100 countries and serves 10 Million+ customers globally.

Historical Performance

Voltas experienced a 31% growth in consolidated revenue for Q3FY24

Profit before tax was INR 24 Cr. in Q3FY24 compared to a loss of INR 80 Cr. in Q3FY23

VoltBek (JV between Voltas and Arcelik) line of home appliances saw volume growth of 65% in Q3FY24

In Q3FY24, the company’s market share in the Window AC Market stood at 35-40% and Split AC at 18-19%

As of Q3FY24, the total order book is estimated to be ~INR 9,000 Cr., with INR 5,500 Cr. in domestic projects and INR 3,500 Cr. in international projects

Industry Overview

According to estimates, the Residential Air Conditioner (RAC) industry in India is expected to witness a robust 15% CAGR in demand for FY23-28E, implying new capacity additions of ~10 million units during the same period

The Indian Washing Machine Market size was valued at ~INR 1,970 Cr. in 2023 and is projected to reach ~INR 4,260 Cr. by 2032, registering a CAGR of 4.1% during the forecast period of 2023 – 2032

The Indian dishwasher market is anticipated to grow at a CAGR of 10.8% from 2023 to 2029, reaching ~INR 94 Cr

The Indian Refrigerator Market size was valued at around INR 30,120 Cr. in 2024 and is expected to reach ~INR 76,180 Cr. by 2033, exhibiting a CAGR of 9.48% during the forecast period of 2024-33

Mool's Narrative

VoltBek JV Turnaround: VoltBek, a joint venture, has already achieved a significant 12.2% market share in the semi-automatic washing machine segment as of Dec’ 2023. The company is poised to reach an overall market share of 7.9% by FY27E, with EBITDA breakeven expected by FY26E

Outperforming the Industry: In a challenging operating environment, Voltas has demonstrated resilience by maintaining its industry-leading profitability. For FY23, the company's PBIT Margins stood at an impressive 8.3%, higher than the industry average of ~2.5%

Demand-Aligned Products: Voltas is well-positioned with a diverse portfolio of over 50 SKUs in the mass premium category, which accounts for 70% of the market demand. This enables the company to cater to evolving consumer preferences effectively

Superior Returns Structure: Voltas' Unitary Cooling Products (UCP) business commands an exceptional ROCE of over 70%, higher than the industry UCP ROCE average of around 20%, reflecting the company's efficient capital allocation and strong profitability

Supply Chain Rework: Voltas has successfully reworked its supply chain in the Residential Air Conditioner (RAC) segment, by optimizing its cost structure and operational efficiency

Valuation and Recommendation

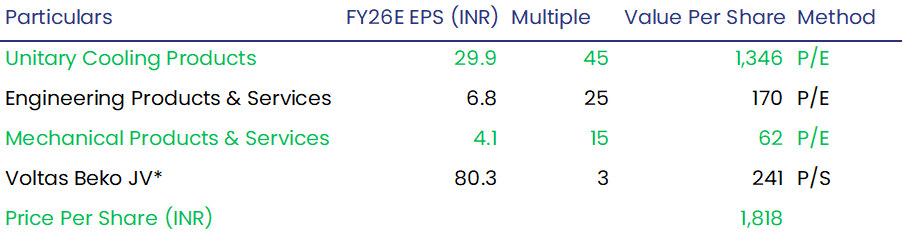

We adopted a SOTP Valuation Approach to value Voltas Limited. We valued Voltas Beko JV based on P/S multiple as the segment is not profitable at this point.

*Sales Per Share

We recommend a "Buy" rating for Voltas Limited, considering its strong profitability, VoltBek JV business improvement, and rising market share in the RAC segment. We anticipate a target price of INR 1818 based on FY26 Estimates, which implies an upside potential of 28% in the stock within the next 12-18 months.

Financial Analysis

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.