Jul 5, 2024

Can Inox Wind Capitalize on India's Renewable Energy Supercycle?

Company Introduction

Inox Wind Limited (IWL) is India’s leading wind energy solutions provider servicing IPPs, Utilities, PSUs & Corporate investors. IWL is a part of the INOXGFL Group which has a legacy of over 9 decades and is primarily focused on 2 business verticals – chemicals and renewable energy. IWL is a fully integrated player in the wind energy market with 4 manufacturing Plants in Gujarat, Himachal Pradesh, and Madhya Pradesh. It manufactures Blades, Tubular Towers, and Hubs & Nacelles.

Q4 & FY24 Financial Performance

FY24 Revenue came at INR 1,799 Cr. with a YoY growth of 139%

The company turned EBITDA positive in FY24 with EBITDA at INR 344 Cr. from a loss of INR 242 Cr. in FY23.

Q4FY24 PAT came at INR 38 Cr. from a loss of INR 115 Cr. in Q4FY23.

Net external interest-bearing debt stands at INR 655 Cr. as of FY24

Mool’s Narrative

Steady Order Book Momentum: Inox Wind is capitalizing on favorable macroeconomic tailwinds, evidenced by its strong order book of approximately 2.7 GW (excluding Letters of Intent). This impressive order book saw an addition of around 2.2 GW during the year, translating into a substantial revenue potential exceeding INR 18,000 Cr.

Seamless Operational Transition: Inox Wind has successfully transitioned to the production of 3-megawatt wind turbines from 2-megawatt turbines in Q4. This strategic move positions the company for gigawatt-scale annual execution capabilities, with a medium-term target of achieving 2 GW of annual execution. The company's focus remains on ramping up the execution of its 3-megawatt wind turbine portfolio.

Supportive Government Policies: Driven by the ambitious goal of achieving 500GW of renewable energy (RE) capacity by FY30, the government has implemented strategic measures to accelerate the sector's growth. These initiatives include elevating bid targets, specifically focusing on allocating 10GW per annum for wind-only RE projects. Additionally, the government has announced plans to float RE bids totaling 50GW over the period spanning FY24-FY28.

Strengthened Financial Position: In a major development, the Inox Wind promoters recently divested a nearly 5% stake in the company, raising INR 900 Cr. These funds were subsequently infused back into the company, enabling Inox Wind to become net debt-free, excluding promoter debt.

Credit Rating Upgrade: Reflecting the improvement in the company's business risk profile and substantial enhancement in operating performance, CRISIL has upgraded Inox Wind's credit rating. The company now carries a 'CRISIL A/Stable' rating for its long-term bank facilities and a 'CRISIL A1' rating for its short-term bank facilities, up from 'CRISIL A-/Stable' and 'CRISIL A2+,' respectively.

Valuation and Outlook

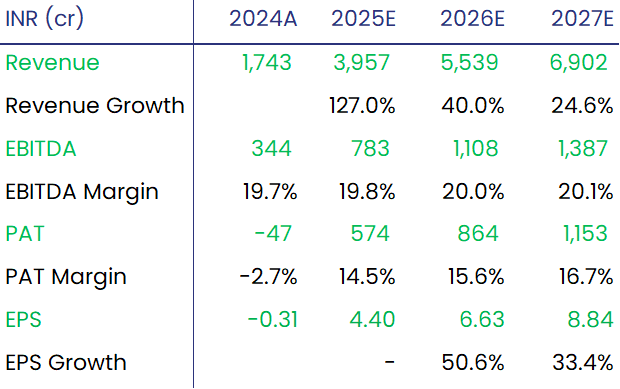

We value Inox Wind at 25x FY2027E Earnings Per Share (EPS), with a target price of INR 221, a projected upside of 51% over the next 12-18 months.

We recommend a "BUY" rating on Inox Wind Limited based on robust guidance for the order book, net debt-free status, and execution uptick over FY25-27.