Aug 20, 2024

Charting a Bright Future: KMEW's Strategic Moves and Market Potential Drive Growth

Overview

Knowledge Marine & Engineering Works Ltd. (KMEW), established in 2015, has rapidly emerged as a leading player in India’s dredging and small-craft sector. The company operates across several segments, including marine craft ownership and operation, dredging, repairs and maintenance, and marine infrastructure refits.

KMEW specializes in designing and constructing vessels for various maritime needs, such as pilot boats, patrol boats, survey boats, mooring boats, tug/service boats, and hopper barges. Each vessel is tailored for specific functions in the maritime industry. The company manages a fleet of about 30 vessels and has worked in over 8 domestic ports, securing more than 5 international ports.(frame it again).

Employing approximately 200 personnel, KMEW's notable achievement includes becoming the first Indian company licensed for marine sand extraction in Bahrain. With an order book of INR450 crore, KMEW has commenced operations in Bahrain, including the deployment of the ‘River Pearl 18’ for sand mining. The projected execution for the second half of FY24 is around INR15 crore. The company plans to collaborate with private organizations like ITD Cementation and L&T for other upcoming dredging projects.

FY24 Financial Performance

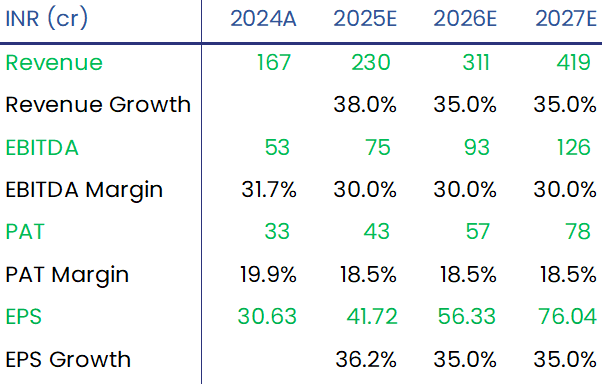

Total Revenue at INR 166.7 Cr. v/s INR 202.9 Cr. in FY23 (-17.8% YoY)

EBITDA at INR 53 Cr. v/s INR 70.6 Cr. in FY23 (-24.9% YoY)

EBITDA Margins at 31.7% v/s 34.8% in FY23 (-310 Bps YoY)

PAT at INR 33.1 Cr. v/s INR 47 Cr. in FY23 (-29.6% YoY)

Orders received and under executions

KMEW secured two contracts from the Inland Waterways Authority of India (IWAI), totaling INR171.2 Cr.

KMEW obtained its first-ever contract from the Mumbai Port Authority, valued at INR34.69 Cr. (excluding fuel consumption cost), for the exclusive hire of two dock tugs over a 7-year term, marking its entry into the tug business.

The company secured a contract from Paradip Port Authority for the supply and hire of a 20-knot speed patrol boat, including manning, for 5 years, valued at INR5.03 Cr.

Completed orders

Completed rock dredging work at Mangrol Fishing Harbour, achieving a project value of INR78 Cr. and executing 1.25 lakh cubic meters of rock dredging.

Promoter Analysis

Saurabh Daswani (Managing Director)

He owns 11.90% of the company

Attained an A+ Grade in Post-Graduation Diploma in Business Administration with specialization in Finance

Responsible for overall management of the organization with over 12 years of experience

Areas of expertise include procurement, new building, vendor management, budgeting, etc. Completed PGDA with specialization in Finance from Symbiosis

Sujay Kewalramani (CEO)

Completed his B.E. in Naval Architecture and Marine Engineering from the State University of New York Maritime College and completed his Post Graduation Diploma in Business Management from Emeritus Institute of Management. (make it short)

Over 20 years of experience in the marine, dredging, and shipping industry with additional experience in ship designing, building, and repairing

Prior experience includes working at L&T Shipbuilding, Mercator, and Adani Ports.

Industry Outlook

The global dredging market is projected to grow at a moderate rate over the next decade. As of 2024, the market size is estimated to be around INR 1.39 lakh Cr., and projected to reach a value of INR 1.7 lakh Cr. by 2034. This growth is driven by increasing seaborne trade, port expansion projects, and infrastructure development related to energy, such as offshore wind farms and LNG terminals.

The projected annual Indian market size is INR 2,490 Cr. for maintenance dredging and INR 830 crore for capital dredging. With 95% of India's foreign trade volume handled through ports, there is significant potential for both dredging and ship repair services.(rewrite)

The Sagarmala Programme is a key government initiative aimed at modernizing and developing ports while enhancing connectivity. It includes over 600 projects, many involving extensive dredging, with a total investment of approximately INR 5.52 Lakh Cr. This initiative is critical for improving India's maritime infrastructure and boosting trade.

Investment Thesis

1. Limited Competition in the Indian Dredging Industry

The Indian dredging market has limited competition, with 4 major players currently in India including Northern Express Infra, Dharti Dredging, Adani Ports and Special Economic Zone, and Knowledge Marine & Engineering Works Ltd. (KMEW), known for its specialized services. This concentrated market presents a strong position for KMEW, especially with increasing demand from key government initiatives.

2. Strategic Opportunity for KMEW in Saudi Arabia’s Port Expansion

Saudi Arabia's maritime sector presents substantial potential, driven by the Kingdom's port development plans. A significant portion of the investment, around 10-15%, is earmarked for dredging activities, which could translate to an anticipated expenditure of approximately INR 24,900 crore to INR 37,350 crore by 2030. KMEW has planned to bid for this opportunity, and Mool believes it will successfully secure this order.

3. Consistent Margins and Strategic Debt Management

The company had previously mentioned in its H2 FY24 call that it would not bid on any orders below 30% EBITDA margins and PAT margins reaching 20%. Its prudent financial management is further reflected in a debt-to-equity ratio of 0.36. (the company announced that it wouldn’t bid on any order below 30% EBITDA

4. Strategic Sand Sales: Secured Contracts with Market Flexibility

The company has secured contracts for 60% of its mined sand (dredged from ports) over the next five years. Leading to reliable revenue for a portion of their sand volume. The remaining 40% is reserved for the open market, allowing the company to take advantage of potentially rising prices.

5. KMEW Anticipates Strong Order Book Growth for FY25

As of March 2024, Knowledge Marine & Engineering Works Ltd. (KMEW) has an order book of INR 733 crore. For FY25, the company expects this to grow to between INR 1,100 and 1,200 crores, with additional orders anticipated throughout the year.

Valuation and Recommendations

We recommend a "BUY" rating on KMEW, based on a strong order book that enhances its competitive edge and opens up greater opportunities for market expansion and growth.

We value KMEW at 30x FY2027E Earnings Per Share (EPS) of INR 79.9, with a target price of INR 2281, a projected upside of 64% over the next 12-18 months.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.