Mar 18, 2024

CEAT Limited: Gearing Up for the Long Haul

Company Overview

Established in 1958, CEAT Limited has evolved from a national contender to a global frontrunner in the tyre industry. The company offers a wide array of tyres for all market segments, including heavy-duty trucks and buses, light commercial vehicles, earthmovers, forklifts, tractors, trailers, cars, motorcycles, scooters, and auto-rickshaws. With a manufacturing capacity of over 15 million tyres annually across multiple facilities in India, CEAT has a strong domestic presence and exports its products to more than 100 countries worldwide.

Historical Performance

Q3 FY24 revenue met expectations at INR 2,963 crore, showcasing strong market performance

Adjusted Profit After Tax (PAT) reported a significant 24.7% YoY increase to INR 177.8 crore

Gross margin decreased by 200 basis points QoQ due to price adjustments in international markets

EBITDA margin outperformed expectations by 100 basis points at around 14%, driven by a 9% reduction in distribution, factory operation, and marketing & advertisement costs

Key Drivers and Investment Thesis

Capacity Expansion: CEAT's strategic investment in expanding its greenfield plant's capacity underscores a 42.5% increase in daily production capability, from 20,000 to 28,500 tyres per day, signifying a robust response to growing market demand.

Focus on High-Growth Segments: With the SUV market growing at a CAGR of ~21% over FY19-23, CEAT's emphasis on higher-diameter and steel radial tyres positions it to capture significant market share in this lucrative segment.

Export Revenue Growth: The company aims to increase its export revenue contribution from 18% to 23-25% in the next 2-3 years, diversifying its geographic revenue streams and mitigating domestic market risks.

OEM Partnerships: CEAT has secured endorsements from 12 leading OEMs, validating its product quality and enhancing its market penetration and competitive edge.

Investment in Innovation: The company's initial investment of ~INR 14 billion in its greenfield site underscores its commitment to long-term growth and manufacturing excellence in the tyre industry.

Financial Analysis and Valuation

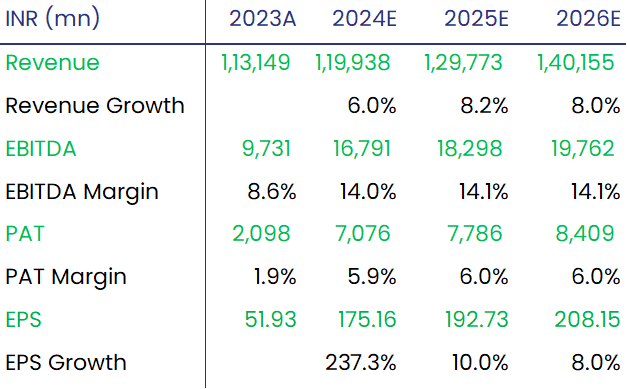

Based on our analysis, we assign a 16x multiple to CEAT's projected FY26 EPS of INR 208.15. This valuation indicates an upside potential of 33%, leading to an anticipated target price of INR 3,330 for CEAT shares in the next 12-18 months.

Recommendation

We recommend a "Buy" rating for CEAT Limited, considering its strong market position, strategic growth initiatives, and robust financial performance. The company's focus on capacity expansion, product innovation, and partnerships with leading OEMs, coupled with its growing global presence, makes it an attractive investment opportunity in the tyre industry.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.