Mar 14, 2024

Gabriel India Limited: Steering Ahead in the Auto Component Industry

Company Overview

Gabriel India Limited operates in diverse business segments, including two- and three-wheelers, passenger cars, commercial vehicles, railways, and the aftermarket sector. The company has a portfolio of over 500 designed products and serves all vehicle segments in India. Gabriel India's leadership in the aftermarket is supported by a network of more than 700 distributors and 20,000 retailers, ensuring its products are widely available across India and in over 30 countries across six continents. The company's vision is to be among the top 5 shock absorber manufacturers worldwide.

Historical Performance

Revenue of INR 2,972 Cr in FY23, marking a 17% CAGR over the FY21-23 period

New orders for axle dampers from DAF Netherlands and a 40% YoY growth in railway volumes in Q3 FY24

EV revenue share at 5%, mirroring the 2W EV market penetration

Exports saw a ~20% YoY drop, but efforts are ongoing to secure significant PV export orders

Investment Thesis

Strategic Alliances with Market Leaders: Gabriel India's client portfolio includes leaders in the ICE and EV sectors, with TVS ICE and M&M showing significant market share gains in Q3 FY24

Significant Gains in EV Market Share: Gabriel India's clients, such as Ola Electric and TVS EV, have registered remarkable retail market share gains in the rapidly evolving EV sector

Innovation at the Helm: Recent business wins, including contracts from TVS Motor, Suzuki, Ola Motorcycles, Tata Motors, and Maruti Suzuki, highlight Gabriel India's robust product innovation and industry trust

Foundation of Excellence: Gabriel India's debt-free status, coupled with cash and investments of ~INR 400 Cr, positions it well for sustainable growth, supported by a history of positive cash flows and management's commitment to achieving 10-11% EBITDA margins

On the Road to Remarkable Growth: The company's growth trajectory is supported by new orders from existing and new clients, aggressive product launch plans by key OEMs, strong performance in the railways segment, and the introduction of high-margin products like the FSD technology

Financial Analysis and Valuation

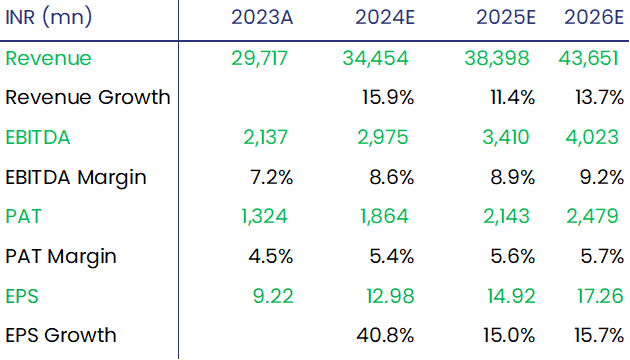

Based on our analysis, we project Gabriel India's FY26 EPS at INR 17.26 and assign a multiple of 25x. This results in a target price of INR 431, implying a 23% upside potential within the next 18 months.

Recommendation

We recommend a "Buy" rating for Gabriel India Limited, considering its strong market position, strategic alliances, and growth prospects in the auto component industry. The company's focus on innovation, diversified product portfolio, and robust aftermarket network, coupled with its solid financial performance, makes it an attractive investment opportunity.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.