Oct 8, 2024

Kross Limited: A Close Look at India's Axle and Suspension Specialist

Company Overview

Established in 1991, the company is a leading manufacturer of trailer axles, suspension assemblies, and high-performance safety-critical parts for medium and heavy commercial vehicles (M&HCV) in India. The company also produces tractor components like PTO shafts, hydraulic lift shafts, and front axle spindles for the agricultural sector. The company has an installed capacity of 60,000 trailer axle and suspension assemblies. Kross Limited also has 2 manufacturing units, 2 forging units and 1 casting unit located in Jamshedpur.

The company is also expanding into international markets, particularly in regions with growing demand for automotive and agricultural machinery. Current international partnerships include collaborations with Leax Falun AB in Sweden and a Japanese OEM.

Recent Developments

Kross Limited successfully listed on NSE and BSE on 16th September 2024 at INR 240/share (same as IPO price). The INR 500-crore public offer, a 50:50 combination of a fresh issue and an offer for sale, received decent investor interest after it was subscribed over 16x.

Core Products and Services

Kross Limited specializes in manufacturing forging components for the automotive industry, primarily serving top OEMs and Tier 1 companies in India. Their product portfolio includes:

1. Trailer parts: axles, suspensions, landing gears, and king pins

2. Tractor components: hydraulic lift assemblies, rear axle assemblies, and spindle front axles

3. Truck components: transmission, rear axle assembly, steering assembly, gear shifting mechanism, and chassis parts

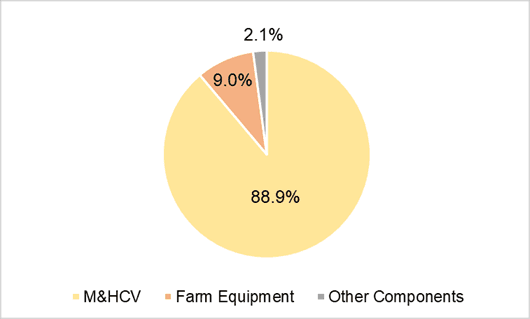

Revenue Split by Segment

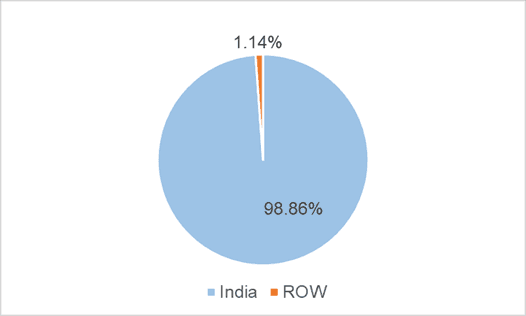

Revenue Split by Geography

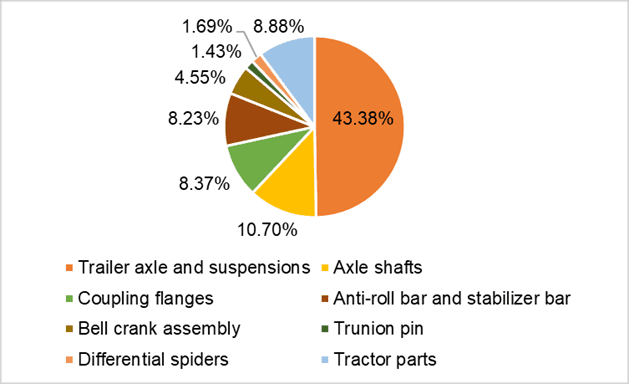

Revenue Split by Product

FY24 Financial Performance

Total Income (incl. Other Income) at INR 621.4 Cr. v/s INR 489.3 Cr. in FY23 (+27% YoY)

EBITDA at INR 80.7 Cr. v/s INR 57.5 Cr. in FY23 (+40% YoY)

EBITDA Margins at 13.0 % v/s 11.7 % in FY23 (+130 Bps YoY)

PAT at INR 44.8 Cr. v/s INR 30.9 Cr. in FY23 (+45% YoY)

Q1FY25 Financial Performance

Total Income (incl. Other Income) at INR 146.4 Cr. v/s INR 143.7 Cr. in FY23 (+2% YoY)

EBITDA at INR 16.6 Cr. v/s INR 15.2 Cr. in FY23 (+9% YoY)

EBITDA Margins at 11.3 % v/s 10.6 % in FY23 (+70 Bps YoY)

PAT at INR 8 Cr. v/s INR 7.7 Cr. in FY23 (-4% YoY)

Promoter Analysis

Sudhir Rai – Chairman and Managing Director

Holds a 37.5% stake in the company

More than 30 years of experience in the auto component manufacturing industries

Holds a bachelor’s degree in science from the University of Delhi and diploma in business administration from the Xavier Institute of Management.

Sumeet Rai – Business Operations and Whole Time Director

Holds a 5.9% stake in the company

More than 15 years of experience in the auto components operations industry

Holds a bachelor’s degree in science in mechanical engineering from the University of Michigan

Kunal Rai – CFO and Whole Time Director

Holds a 5.5% stake in the company

More than 12 years of experience in the auto component manufacturing industries

Holds a bachelor’s degree in science from Aston University.

Market Segmentation M&HCV Industry

The M&HCV sector includes vehicles with a Gross Vehicle Weight (GVW) greater than 7.5 tonnes, covering a range of heavy-duty trucks, buses, and specialized commercial vehicles. This segment is further categorized as follows:

Medium Commercial Vehicles (MCVs): Encompassing vehicles with a GVW ranging from 7.5 to 16.2 tonnes, MCVs are typically utilized for regional distribution, urban transport, and short-haul operations.

Heavy Commercial Vehicles (HCVs): These vehicles have a GVW exceeding 16.2 tonnes and are predominantly used for long-distance transport, heavy-duty tasks in mining, construction, and extensive logistics operations.

Industry Dynamics

The Indian M&HCV sales are expected to grow at 2-4% CAGR from 2024 to 2029, to reach ~4.7 Lac units sold/year

The top players in the Trailer Tractor ancillary space are York Transport Equipment India Private Limited, Kross Limited and Tata Motors Limited

York Transport Equipment has the largest market share of ~50% followed by Kross Limited with ~30%.

Investment Thesis

Capacity Expansion to boost top-line growth

The company has announced a capex of INR 70 Cr. that will be spent in FY25, out of which INR 30 Cr. will be spent on Axle Beam Extrusion Technology, INR 22 Cr. on Forging Unit and INR 15 Cr. on new production lines dedicated to exports.

Margin Expansion by New Technology Adoption

The company is the first in India to establish Axle beam extrusion technology. This technology will enable the company to produce more efficient axles with a 3% cost reduction, improving their EBITDA margins by 190-200 bps by FY26.

Full Backward integration

Kross Limited has a fully backward integrated manufacturing with in-house manufacturing, forging and casting plants. This benefits the company to have control over costs and improve operating margins upto 13%

Healthy Income Growth

The company has tripled its bottom-line growth in the last 3 years from INR 12 Cr. in FY22 to INR 45 Cr. in FY24. The management expects the growth at a similar pace in the next 3 years at 20% CAGR

Strong Fundamentals

The company used it net proceeds from the IPO to repay its debt worth 90 Cr. which lowered its Debt-to Equity to 1.1x which will further boost the bottom-line of the firm.

Company Specific Risks

Revenue Concentration

Kross Limited earns its 66% revenue from its top 5 customers which is a significant business risk and any customer defection can cause a huge revenue loss.

Unregistered Logo and Trademark

The company faces potential legal and reputational risks due to the absence of a registered logo and trademark, which could lead to unauthorized use, loss of brand identity, and challenges in protecting its intellectual property.

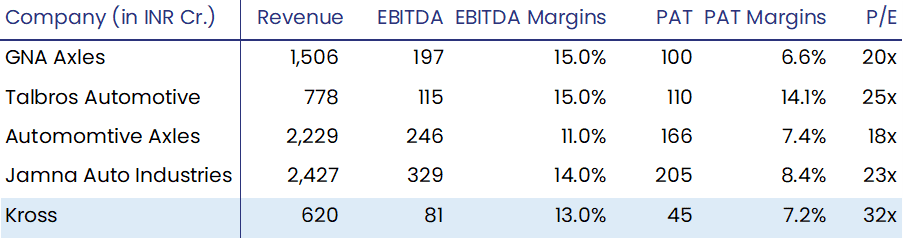

FY24 Peer Analysis

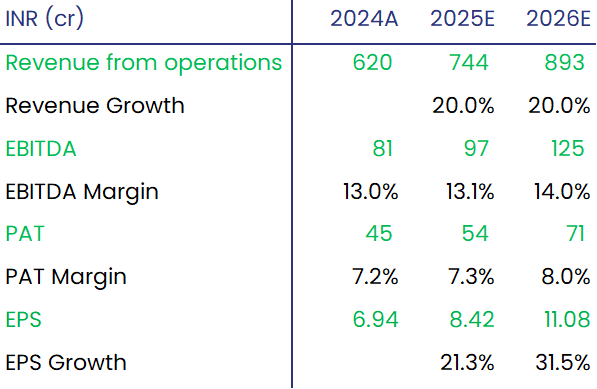

Valuation and Recommendation

We value Kross Limited at 25x FY2026E Earnings Per Share (EPS) of INR 11.1, with a target price of INR 276, a projected upside of 40% over the next 12-18 months.

We recommend a "BUY" rating on KROSS based on its sustained operating margins, strong fundamentals and decent bottom-line growth.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.