Sep 3, 2024

Krystal Integrated Services : Strategic Approach to Market Expansion

Overview

Krystal Integrated Services Ltd provides integrated service solutions across sectors such as healthcare, education, public administration, airports, railways, metro infrastructure, retail, and waste management. The company is known for its comprehensive and tailored approach, supporting both public and private sector projects, including large-scale, multi-location engagements.

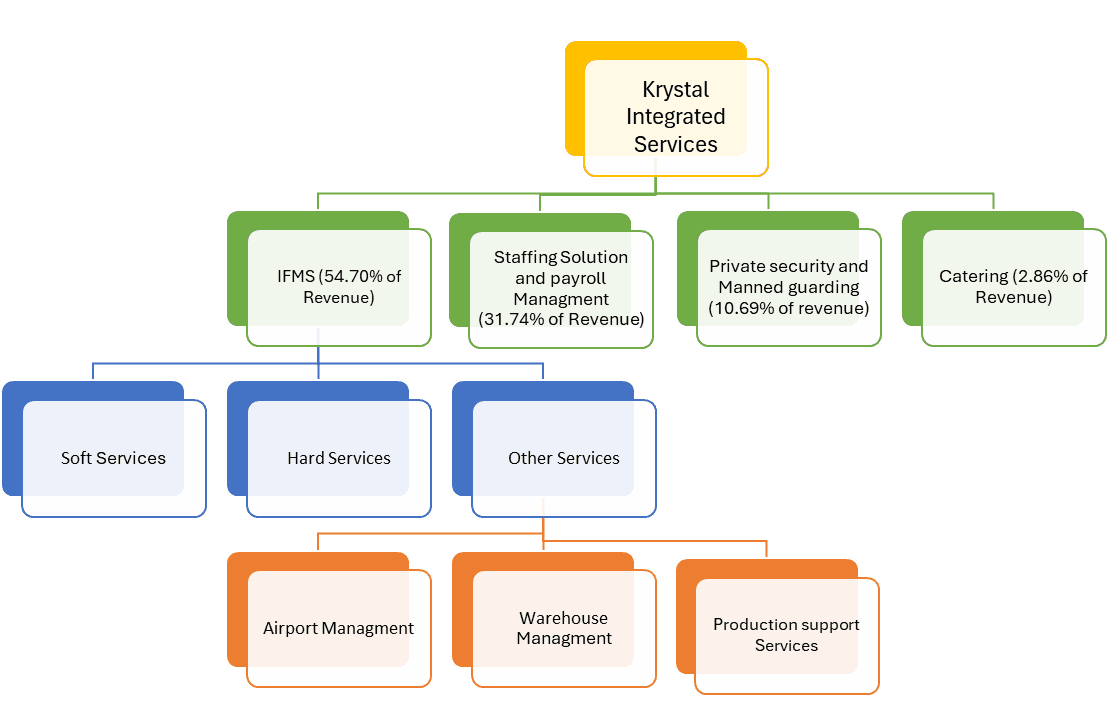

Krystal’s business is diversified into four main segments: Integrated Facility Management Services (IFMS), Security Services, Staffing and Payroll Solutions, and Catering Services.

Krystal's growth includes a major milestone with its IPO on March 21st, which was oversubscribed by 13 times, raising INR 300 Cr. The funds are being used for debt repayment, working capital, CAPEX, and new machinery

Revenue for Krystal is divided with 70% coming from government contracts and 30% from corporate contracts. The company employs 41,061 on-site employees, serving 369 customers across 2,487 locations through 28 branches. Operating in 17 states and 2 union territories, Krystal provides services to key government customers in healthcare, education, airports, railways, and metro infrastructure sectors.

Notable clients include Maha Mumbai Metro Operation Corporation Limited and the Education Department of Brihanmumbai Municipal Corporation. Krystal also serves municipal bodies, state government entities, electricity boards, and district consumer forums.

Krystal has maintained a 100% contract renewal or extension rate for its nongovernment customers during FY21, FY22, FY23, and FY24.

Promoter Analysis

Sanjay Suryakant Dighe – CEO & Whole-time Director

Degree in mechanical engineering from Abhinava Abhiyantriki Mahavidyalaya, Pune

Previously associated with Birla Sun Life Insurance Company Limited. Associated with the Company as a Director since December 8, 2010.

Involved in the core business management activities and focuses on long-term growth and strategy planning

Barun Dey – CFO and President – Finance & Accounts

Associate member of the Institute of Chartered Accountants of India

Previously associated with G4S Secure Solutions (India) Private Limited.

Associated with the Company since July 4, 2019

Financial Performance for FY24

Total Revenue at INR 1034.9 Cr. v/s INR 715.6 Cr. in FY23 (+44.6% YoY)

EBITDA at INR 76.9 Cr. v/s INR 58.3 Cr. in FY23 (+31.9% YoY)

EBITDA Margins at 7.4% v/s 8.1% in FY23 (-70 Bps YoY)

PAT at INR 34.32 Cr. v/s INR 26.9 Cr. in FY23 (+27.5% YoY)

Industry Outlook

The government sector has experienced a CAGR of 10.4% during FY18–FY23, outpacing the 6% growth recorded by the private sector. In the long term, the government sector is expected to offer significant growth opportunities for Facilities Management. Key segments driving this opportunity include Industrial, Public Administration, Airports, Educational Institutions, Healthcare, and Railways & Metros.

The global facility management market was valued at 10 Lakh Cr. in 2023 and is expected to grow INR 16L Cr. by 2030, with a CAGR of 6.7% during the forecast period.

The Indian Facility Management Market, valued at INR 1L Cr. in 2024, is anticipated to expand to INR 1.76L Cr. by 2029, with a CAGR of 7.37% over the forecast period from 2024 to 2029

Investment Thesis

Strategic Objectives for Customer Growth

Krystal is focused on retaining, strengthening, and expanding its customer base by leveraging its diverse offerings and regional presence. The company has seen a 40% increase in its customer base, growing from 262 in FY23 to 369 in FY24. By positioning itself as a one-stop solution, Krystal aims to provide bundled services and increase wallet share among its clients. Additionally, the company plans to optimize bid selection and pricing strategies to meet government contract criteria better.

Staffing Solutions and Payroll Management

This division manages recruitment, payroll, and HR services, providing skilled, semi-skilled, and unskilled labor based on client requirements. Key clients include HDFC Bank Limited, with services extended to 140 customers across 1,323 locations.

Workforce Distribution Across Key Operational Areas

Krystal's on-site workforce is strategically distributed across essential operational areas, ensuring comprehensive service delivery. The company employs 22,915 individuals in Integrated Facilities Management Services (IFMS), 12,222 in staffing, 5,810 in security, and 114 in catering.

Valuation and Recommendation

We recommend a "BUY" rating on Krystal Integrated Services Ltd, supported by the company’s robust service capabilities, extensive geographic presence, and strategic growth into diverse business segments.

We value Krystal Integrated Services Ltd at 22x FY2027E Earnings Per Share (EPS) of INR 46.12, with a target price of INR 1153.11, representing a projected upside of 25.5% over the next 12-18 months.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.