Mar 14, 2024

Lemon Tree Hotels: A Fresh Approach to Hospitality

Company Overview

Lemon Tree Hotels, established in 2002, has rapidly expanded to become one of India's largest hotel chains in the mid-priced hotel sector. The company operates over 100 hotels with more than 9,700 rooms across 64 destinations in India, catering to both business and leisure travellers. Lemon Tree is known for its contemporary and cheerful interiors, personalized service, and friendly staff, aiming to create a homely atmosphere for its guests. The company launched its Aurika Hotel brand to service the high-end customer base in Mumbai.

Historical Performance

24% YoY increase in revenue to INR 2,880 Cr in Q3 FY24; Revenue at 145% of the depressed Q3 FY20 level

Average Revenue Rate (ARR) up 10% YoY, RevPAR (Revenue Per Available Room) up 8% YoY, with occupancy declining from 68% to 66% in Q3 FY24

EBITDA margin down 575bps to 48.4%, impacted by renovation costs and increased payroll

Industry Outlook

Travel & tourism industry's contribution to India's GDP estimated at over $199.3 billion in 2023, expected to reach $488 billion by 2029

Industry's direct contribution to GDP expected to record an annual growth rate of 7-9% between 2019 and 2030

Union Budget 2023-24 allocated an outlay of $170.85 million for the Swadesh Darshan Scheme

Indian hotel market estimated at ~$32 billion in FY20, expected to reach ~$52 billion by FY27

Key Drivers and Investment Thesis

Strategic Expansion with Aurika Sky City: Lemon Tree unveiled Aurika Sky City in October 2023, featuring a 669-room hotel, the largest in India by room count, near Mumbai International Airport. The prime location and upscale amenities position Aurika MIAL to achieve an ARR of approximately INR 12,000-15,000 and maintain occupancy rates above 70%.

High Profitability and EBITDAR Margins: Aurika hotels stand out for their profitability, with an EBITDAR margin of around 64% in FY23, substantially higher than Lemon Tree's other brands (18-41%).

Growth Boost from Convention Centers: The re-ignition of convention centers is poised to bolster Lemon Tree's growth trajectory, leading to higher occupancy rates and room tariffs across the region.

Robust Pipeline and Expansion Plans: The operational roadmap from CY24 to CY28 focuses on expanding the total room network to over 20,000 rooms, with a significant emphasis on an asset-light model (70% managed rooms).

Long-term Growth Outlook: The pipeline inventory, set to become operational between FY24-FY27E, will increase the total rooms to approximately 12,852, with managed rooms accounting for about 55% of the total.

Financial Analysis and Valuation

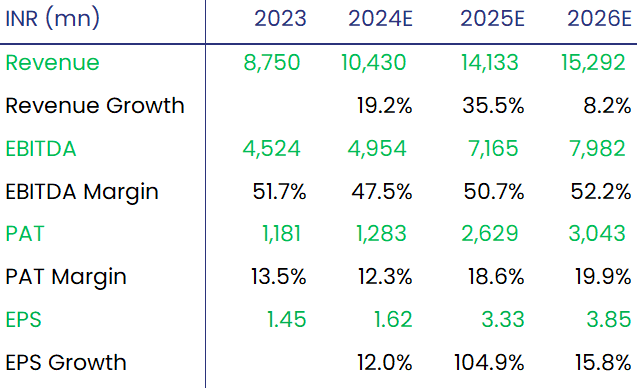

Based on earnings growth assumptions of 19% for FY24, 35% for FY25, and 8% for FY26, along with a terminal growth rate of 10.75% and a cost of equity derived from a beta of 1.1, risk-free rate of 7.2%, and risk premium of 8.33%, we estimate the intrinsic value of Lemon Tree Hotels' stock at INR 210. This suggests a potential upside of 33% within the next 12-18 months.

Recommendation

We recommend a "Buy" rating for Lemon Tree Hotels, considering its strong market position, strategic expansion plans, and growth prospects in the Indian hospitality sector. The company's focus on the Aurika brand, high operational efficiency, and asset-light strategy, coupled with the industry's growth potential, makes it an attractive investment opportunity.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.