Mar 14, 2024

LT Foods: Feeding the World, One Grain of Basmati at a Time

Company Overview

LT Foods is renowned for its expansive array of rice and rice-based products, with its flagship brand "Daawat" leading the charge in the basmati rice segment. The company has a global presence, serving over 80 countries across diverse continents, including the United States, Europe, the Middle East, and Asia. LT Foods is committed to sustainability and unparalleled quality, leveraging cutting-edge technology and rigorous quality control measures to deliver products that surpass the highest industry standards.

Historical Performance

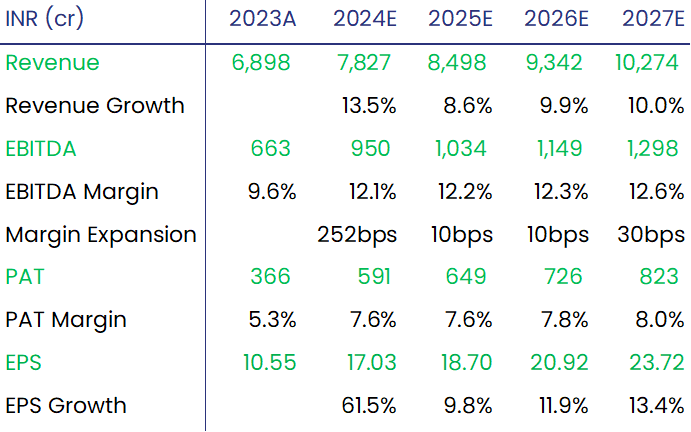

Profit growing at a 22% CAGR for the last 10 years, with a PAT of INR 366 Cr in FY23

Revenue at INR 6,898 Cr in FY23, up 22% YoY

Steady EBITDA margins in the range of 10-11% for the last 5 years

Industry Outlook

Global rice market projected to expand from $376.54 billion in 2024 to $436.51 billion by 2029, with a 3% CAGR

Raw basmati rice anticipated to experience the highest growth rate, with a CAGR of 10.6% during 2022-2027

Ready-to-eat food sector expected to grow from $402.90 billion in 2024 to $512.74 billion by 2029 at a 4.94% CAGR

Key Drivers and Investment Thesis

Dominating Market Shares: LT Foods' brands Royal and Daawat command 40% and 30% market shares in the U.S. and India, respectively, showcasing their strong market presence

Strategic Growth Plan: LT Foods targets a 10% CAGR on a constant currency basis across its Basmati & Other Specialty Rice and Organic Foods & Ingredients segments, as outlined in its five-year strategic plan leading up to FY28-29

Profitability Enhancement: The company aims for a 150 basis points improvement in EBITDA margin over the next five years, indicating a focus on profitability alongside top-line growth

Ready-to-Eat Market Expansion: LT Foods expects the ready-to-eat segment to grow at a 33% CAGR over the next five years, targeting an 8-9% revenue share from this segment

Supply Chain Resilience: Despite logistical challenges and increased transportation costs due to disruptions in the Red Sea, LT Foods anticipates a manageable impact on revenue, estimated at approximately INR 4 Cr per month during Q1 FY25

Financial Analysis and Valuation

Based on our analysis, we anticipate a target price of INR 272 for LT Foods in the next 18-24 months. We assign a target PE multiple of 11.5x to the projected FY27 EPS of INR 23.4, reflecting a potential upside of 50% in the stock price.

Recommendation

We recommend a "Buy" rating for LT Foods, considering its strong market positioning, robust export demand, and strategic growth initiatives. The company's focus on premium and convenient food options, coupled with its global presence and commitment to quality, makes it an attractive investment opportunity in the global food industry.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.