May 7, 2024

Maruti Suzuki: India's Mobility Giant

Company Introduction

Maruti Suzuki Limited, founded in 1981, stands tall as India's largest automobile manufacturer with a dominant market share of over 40%. With a production capacity exceeding 150 lakh vehicles annually, the company boasts an extensive product lineup, including popular models like the Swift, Baleno, and Alto. The company has a burgeoning export market spanning over 125 countries. Its vast network of over 3,000 sales outlets ensures wide market coverage, contributing to its status as a reliable car company. The company owns a pre-owned car-selling business under the brand name "True Value", which crossed 500 lakh units in sales as of Aug'23.

Historical Performance

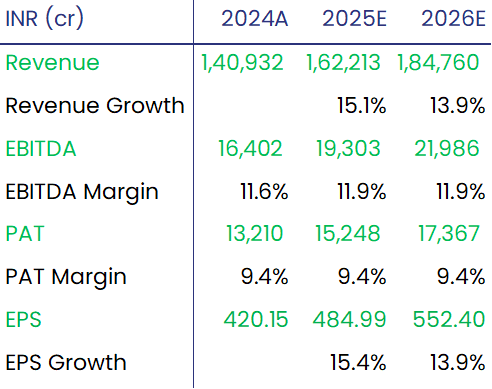

The company sold a total of 213.53 lakh vehicles during FY24, a growth of 8.6% over that in FY23. Sales volume in the domestic market stood at 185.23 lakh units and exports at 28.31 lakh units

It registered net sales of INR 1,34,937.8 Cr. in FY24, a YoY growth of 19.9% over the net sales of INR 1,12,500.8 Cr. in FY23

It achieved a net profit of INR 13,209.4 Cr. in FY24, 64% higher than the net profit of INR 8,049.2 Cr. in FY23

The company announced highest ever dividend payout of INR 125 per share for FY24

Industry Overview

The Indian Electric Car market is expected to reach ~43 lakh units in 2030. The electric car market in India will grow at a 56.0% CAGR during 2024–2030. Increasing FDI, government efforts to develop charging infrastructure, and construction of manufacturing facilities are the primary drivers.

The India CNG Vehicles Market size is estimated at INR 7,760 Cr. in 2024 and is expected to reach INR 11,214 Cr. by 2029, growing at a CAGR of 7.66% during the forecast period of 2024-29.

According to Goldman Sachs estimates India will become the world's third-largest car market by 2025, with 740 lakh vehicles.

Key Drivers and Investment Thesis

EV Production: The company is on course to start production of battery electric vehicle (BEV) eVX in FY25 catering to the premium segment customer profile. The BEV has a range of 550 km and 60 kWh battery pack.

Rising Market Share: Maruti Suzuki has gained share in FY24 driven by its aggressive model launches (new products constitute Grand Vitara, Fronx, Jimny, and Invicto models). MSIL's UV (including MPV) market share shall rise from 26% in FY24 to 28% in FY26E. The E-SUV (eVX model) launch should support volumes in FY26E. Overall, the PV market share is likely to sustain at 43% over FY24–26E.

Growth in the CNG Segment: Maruti Suzuki sold ~48 lakh CNG vehicles in FY24 and expects to sell 60 lakh units in FY25.

Robust Order Book: The pending order book as of Mar'24 stands at ~20 lakh units. Of this, 11.1 lakh units are for CNG vehicles.

Capacity Expansion: FY31 capacity is expected at 400 lakh units. The greenfield plant at Kharkoda (Haryana) is under construction, and the first line of 25 lakh units will likely be operational in 2025. The total capacity at this plant would be 100 lakh units.

Valuation and Recommendation

We valued Maruti Suzuki Limited based on FY26E EPS which is seen at INR 552.4 and assigned a multiple of 28x which indicates a target price of INR 15,467. This implies an 18% upside in the stock price within 12-18 months.

We recommend a "BUY" rating on Maruti Suzuki Limited based on the robust demand for cars and dominant market share.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.