Feb 22, 2024

Navigating the Future: SPRL's Strategic Mastery in the Automotive Sector

Company Overview

Shriram Pistons and Rings Ltd. (SPRL) is a prominent player in the automotive sector, specializing in the production of pistons, piston pins, rings, and engine valves. The company currently holds a dominant market share of 40-45% in its core product segments and an impressive 90% share in the CNG engine market, solidifying its position as a market leader.

Industry Dynamics and Strategic Positioning

The automotive industry is undergoing a significant transformation, with a gradual shift towards Electric Vehicles (EVs). However, SPRL's strategic focus on upgrading Internal Combustion Engine (ICE) technology and introducing greener variants such as Hybrid, CNG, and biofuels positions the company well to capitalize on the growing market for the ICE-2W (Two-Wheeler) segment. With the ICE-2W segment expected to reach 86 million units in the next 8 years and SPRL's current exposure to this segment being less than 20%, the company has significant room for growth and market capture.

Diversification and Future Growth Prospects

SPRL has made strategic investments to diversify its portfolio and tap into the growing EV market. The company has acquired a 66% stake in EMF Innovations, a manufacturer of core EV components, and a 62% stake in Takahata Precision, a key player in high-precision parts. These investments are expected to contribute around 10% to SPRL's sales by FY2026, providing a new avenue for growth and diversification. By proactively venturing into the EV component market, SPRL is well-positioned to benefit from the evolving industry landscape and mitigate potential risks associated with the transition to EVs.

Financial Performance

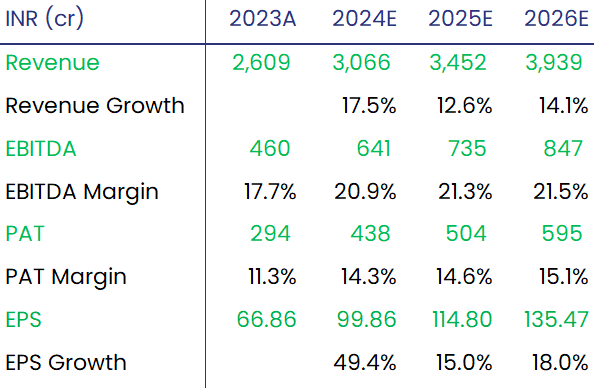

In Q3FY24, SPRL reported impressive financial results, indicating strong growth and profitability. The company's revenue stood at INR 766 crore, representing a 20.4% year-over-year (YoY) increase from INR 636 crore in the corresponding quarter of the previous year. Expenses also rose by 17.2% YoY to INR 641 crore. Despite the increase in expenses, SPRL's consolidated net profit surged by 44.0% YoY to INR 108 crore, up from INR 75 crore in the same quarter last year. These robust financial metrics demonstrate the company's ability to drive revenue growth while managing costs effectively, resulting in improved profitability.

Valuation and Recommendation

Based on our comprehensive analysis, we assign a target multiple of 19x with an estimated FY26 Earnings Per Share (EPS) of approximately INR 136. This translates to a price target of INR 2,570 over the next 18 months, representing a potential upside of 45% from the current stock price. The assigned target multiple takes into account SPRL's strong market position, growth prospects, and diversification efforts, justifying a premium valuation compared to industry peers.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.