Mar 14, 2024

Amara Raja Batteries Limited: Charging Up for the Future

Company Overview

Established in 1985 as a joint venture between the Amara Raja Group and Johnson Controls Inc., ARBL has emerged as a frontrunner in the manufacture of lead-acid batteries. The company has diversified its product offerings by assembling lithium battery packs and producing chargers, catering to clients across various sectors, including Piaggio, Mahindra, Omega SEKI, Indus Towers, and BSNL.

Industry Outlook

The Indian government aims to achieve 30% EV adoption by 2030, primarily driven by the electrification of two-wheeler, three-wheeler, and commercial vehicles

The lithium-ion battery industry in India is predicted to grow from 2.9 GWh in 2018 to about 132 GWh by 2030, at a CAGR of 35.5%

The global industrial batteries market is projected to reach $28.1 billion in 2027, growing at a CAGR of 9.2%

Historical Performance

Revenue growth at a CAGR of 11% from INR 6,059 Cr. in FY18 to INR 10,386 Cr. in FY23

Net profit expansion at a CAGR of 10% over the same period

Stable EBITDA margin around 15-16% and ROE consistently in the range of 20-22%

Strategic Initiatives and Growth Drivers

Lithium Cell Manufacturing Facility: ARBL plans to commence operations at its lithium cell manufacturing facility by FY26, initially focusing on NMC cell chemistry. The facility is projected to achieve an asset turnover ratio of 1-1.2x at optimal utilization, with potential to reach 1.4-1.5x through productivity improvement initiatives

Investment in Advanced Battery Technology: ARBL invested $40 million in Log9, a Bengaluru-based deep-tech battery startup. This investment will increase Log9's monthly battery pack production capacity from 3,000 to 24,000-27,000 units

Comprehensive Distribution Network: ARBL boasts a robust network comprising 23 branches, 39 distribution points, over 500 Amaron Franchisees, more than 100,000 Points of Sale, 1,000 Power Zone Retail stores, and 2,000 extensive service hubs across India

Export Expansion: The company has initiated shipments to North America and aims to expand battery exports to over 80 countries by FY28

Financial Analysis and Valuation

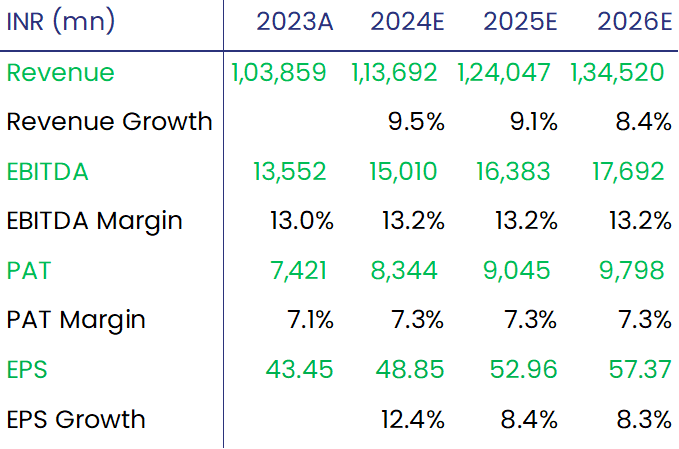

Based on our analysis, we project ARBL's FY26 EPS at INR 57.37 and assign a multiple of 20x. This results in a target price of INR 1,147, implying a 27% upside potential within the next 12-18 months.

Recommendation

We recommend a "Buy" rating for Amara Raja Batteries Limited, considering its strong market position, strategic initiatives, and growth prospects in the rapidly expanding EV and lithium-ion battery markets in India. The company's diversified product portfolio, investment in advanced battery technologies, and extensive distribution network further strengthen its investment case.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.