Jul 9, 2024

Sigachi Industries: Leading the Charge in MCC Innovation

Company Introduction

Sigachi Industries is a leading Microcrystalline Cellulose (MCC) manufacturer in India. The company has a diverse product portfolio of 59 grades of MCC. The core product caters to diverse sectors, with revenue primarily generated from pharmaceuticals (75%), followed by food & nutraceuticals (20%), and cosmetics (5%). The company operates 3 multi-locational manufacturing facilities in Telangana (Hyderabad) and Gujarat (Dahej), ensuring a robust and reliable supply chain for its global clientele.

Sigachi Industries Limited exports approximately 60% of its products to global regulated markets in 40+ countries worldwide. It caters to the American market through a subsidiary called Sigachi US Inc. To address growing demand and capture new markets, Sigachi is aggressively expanding its MCC manufacturing capacity by over 50% in the medium term.

FY24 Financial Performance

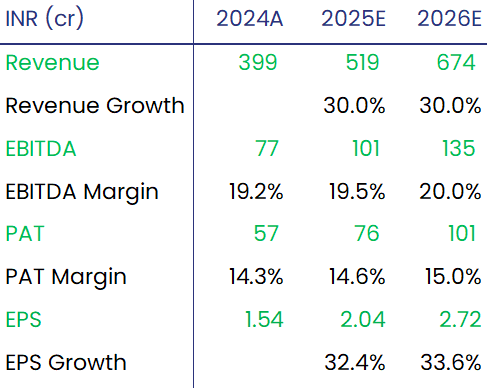

Revenue from operations increased by 32.1% YoY, from INR 302.0 Cr. in FY23 to INR 398.9 Cr. in FY24.

EBITDA grew by 30.5%, from INR 58.7 Cr. in FY23 to INR 76.6 Cr. in FY24.

EBITDA margin slightly decreased from 19.5% in FY23 to 19.2% in FY24, due to lower capacity utilization.

PAT increased by 31.2%, from INR 43.6 Cr. in FY23 to INR 57.2 Cr. in FY24.

Diluted EPS increased by 8.5% from INR 1.42 in FY23 to INR 1.54 in FY24.

Industry Outlook

The Indian Pharmaceutical Industry size was INR 33,400 Cr. in 2021 and is projected to triple and reach ~INR 1,08,550 Cr. in 2030.

The Indian nutraceuticals market size was estimated at INR 22,436 Cr. in 2023 and is projected to grow at a CAGR of 13.5% from 2024 to 2030.

The Indian Cosmetic Market was valued at INR 6,764 Cr. in 2023 and is expected to reach INR 15,364 Cr. by 2032, at a CAGR of 3.2% during the forecast period 2023 – 2032

Key Drivers and Investment Thesis

Rising Capacity Utilization: The newly added capacity of 7,200 MTPA in Q4FY24 increased total capacity to 21,000 MTPA. The expanded capacity is expected to achieve 2300 bps higher utilization in Q1FY25 at 97%.

Diverse Product Portfolio: The company offers 59 distinct grades of MCC, ranging from 15 microns to 250 microns, demonstrating a wide range of product offerings. This positions Sigachi as a key player in the pharmaceutical supply chain.

New Product Line: Introduction of CCS (Croscarmellose Sodium) as a new product which is expected to have an average realization of INR 400-450 per kg. The proposed CCS capacity is 1800 MTPA at Dahej.

API Business: The company acquired an 80% stake in Trimax Bioscience to expand into API product offerings. This backward integration can reduce the formulator’s input cost.

Healthy Capex: Capex for FY25 allocated ~INR 100 Cr., including investments in Trimax and the Hyderabad plant. Capex for FY26 is estimated to be ~INR 80-90 Cr., compared to INR 85 Cr in FY24.S

Growing Asset Turn: The asset turnover ratio is projected to be ~3x, inclusive of new capacity additions in FY26 as compared to 2.2x in FY24

Margin and Profitability Expansion: Focus on high-margin yielding product mix and cost-effective manufacturing processes, effective management of inventory would result in an increase of EBITDA margins in coming quarters to 20%+.

Valuation and Recommendation

We value Sigachi Industries at 30x FY2026E Earnings Per Share (EPS), with a target price of INR 81, a projected upside of 36% over the next 12-18 months.

We recommend a "BUY" rating on Sigachi Industries Limited based on increasing capacity utilization, expansion in API business and asset turnover uptick over FY25-27.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.