Mar 28, 2024

Technical Pick of the Week #1 - Tata Power

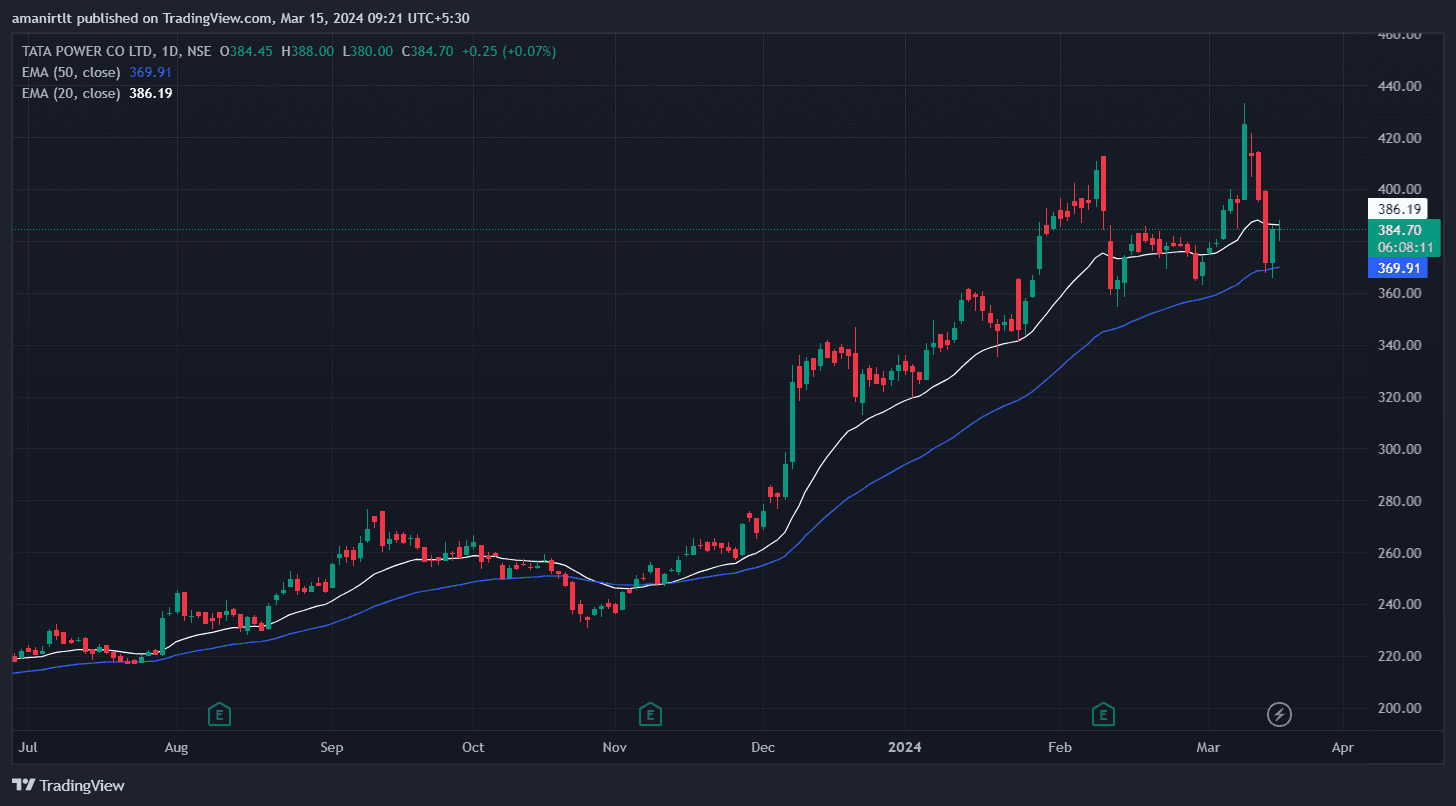

Price Action Analysis:

The stock gave a fresh breakout above 410 in the last week. The volume was greater than average which reflects a strong momentum. A strong bounce was seen around the 375-380 zone which indicates a buy-on-dips momentum.

Moving Average:

The stock has been trading above the 50 for the last 4 months. A buy trade can be initiated as the stock breaks the 20-EMA level.

Bollinger Bands:

The stock successfully broke the band with huge volume which reflects a fresh breakout. The middle band is at 380-385 zone which will act as a strong support in the upcoming weeks.

Mool’s Outlook:

We anticipate a target of 470 in the stock in the next 6 months, which reflects a 14% upside in the stock.

Stop Loss should be maintained at INR 387.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.