Aug 16, 2024

The Golden Age of Indian Wealth Management: The Rise of Affluent Investors

Industry Overview

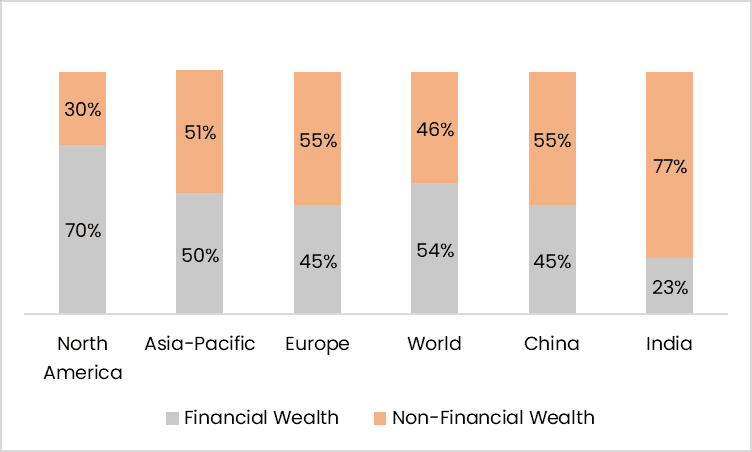

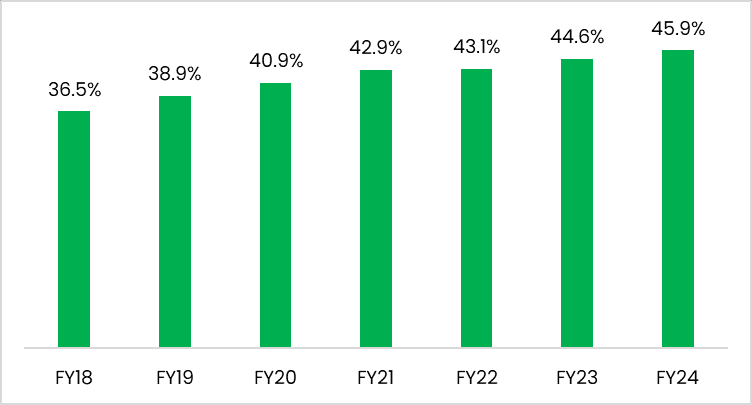

The wealth management industry in India is set for significant growth, driven by key structural trends. The high-income segment has seen rapid expansion, with the number of individual tax filers earning over INR 1 Cr. growing at an 18% compound annual growth rate (CAGR) over the past decade, compared to a 10% CAGR for total tax filers. Additionally, the number of HNIs (High Net Worth Individuals), those possessing more than INR 8 Cr. in liquid financial assets, has increased at a 21% CAGR over the last 5 years and is expected to grow at a 16% CAGR over the next 5 years. This expansion is reflected in the rising AUM (AUM) for high-ticket financial assets, where HNI investments in Portfolio Management Services (PMS), Alternative Investment Funds (AIFs), and HNI-specific Mutual Funds (MFs) represented ~46% of the total AUM in FY24, up from 36.5% in FY18. Financial wealth constitutes less than 25% of total wealth in India, compared to a world average of 54% which highlights the high scope of this industry.

Global Wealth Split

HNI AUM (% of total AUM)

Investment Thesis

Rising AUM in High-Ticket Financial Assets:

The overall HNI AUM has seen consistent growth of over 22% CAGR, reaching INR 26L Cr. in FY24 from INR 5L Cr. in FY16.

Under-Penetration of Professional Wealth Management:

Wealth under professional management in India is less than 15% of total financial wealth, significantly lower than China’s 68% and the global average of 54%.

Diversification as a Strategic Advantage

Companies that diversify into asset management, particularly high-yield segments like AIFs and PMS, will likely improve profitability and reduce the impact of cyclical fluctuations. For example, 360 ONE has a notable presence in AIF and PMS markets, with a 5% market share in AIF distribution and 9% in AIF manufacturing.

Promoter Selling as a Key Opportunity:

Promoters of top NSE 500 companies have cumulatively sold assets worth INR 3L Cr. since FY20, providing a significant raw material for wealth managers.

Risks and Challenges:

Yield Management Challenges:

Recurring assets, such as those in advisory models, face yield compression due to regulatory changes (e.g., TER caps in mutual funds) and a preference for direct investments by UHNIs. The retention rates for advisory assets are significantly lower at 26-30 basis points (bps) compared to 50-55 bps for AUMs with distribution trail commissions.

Cyclical Revenue Dependence:

Transaction income remains a substantial portion of revenue, contributing 50-65% of total wealth management revenue, excluding lending. This dependency makes the revenue base cyclical, as it is influenced by market conditions and investor sentiment.

Top Listed Wealth Management Companies:

360ONE Wealth

360ONE, one of India's largest wealth and alternative asset managers, reported impressive financial performance for FY24, with a revenue of INR 2,924.73 Cr. and a net income of INR 804.21 Cr. Serving over 7,400 HNIs and UHNIs, along with more than 9L transacting users, including 1.1L+ revenue-generating clients, 360 ONE WAM achieved a total AUM of over INR 4L Cr. in FY24. Notably, Wealth ARR AUM grew from INR 40,655 Cr. in FY20 to INR 1L Cr. in FY24, reflecting a CAGR of 39%, while Wealth ARR Revenues increased from INR 412 Cr. in FY20 to INR 847 Cr. in FY24, with a CAGR of 20%

Anand Rathi Wealth

Anand Rathi Wealth delivered a robust performance in FY24, with revenue reaching INR 751.97 Cr. and PAT growing by 40% YoY to INR 224.97 Cr., reflecting a 30% CAGR. Revenue surged 35% YoY with a 22% CAGR. The company’s AUM (AUM) grew by 19% YoY to INR 57,807 Cr., contributing to total platform assets of INR 1L Cr. Anand Rathi serves 20.6L clients, supported by 5,994 mutual fund distributors, with active client families numbering approximately 37,942. The firm has expanded its team by adding 39 new RMs over the past year. The current AUM distribution shows that 20% is held by clients with assets between INR 50Ls and INR 5 Cr., 56.4% by clients with assets from INR 5 Cr. to INR 50 Cr., and 23.6% by HNI with assets exceeding INR 50 Cr.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.