Mar 14, 2024

Unleashing the Potential of Eicher Motors: A Deep Dive into an Automotive Giant

Company Introduction

Founded in 1948, Eicher Motors is perhaps best known for its iconic brand, Royal Enfield, which manufactures the world-famous line of motorcycles characterized by their classic designs, robust engineering, and distinctive thumping engine sounds. VECV, a joint venture with Sweden's AB Volvo, named Volvo Eicher Commercial Vehicles Limited currently commands a 15-18% market share in the Indian commercial vehicle segment, making it a formidable player in this space

Historical Performance

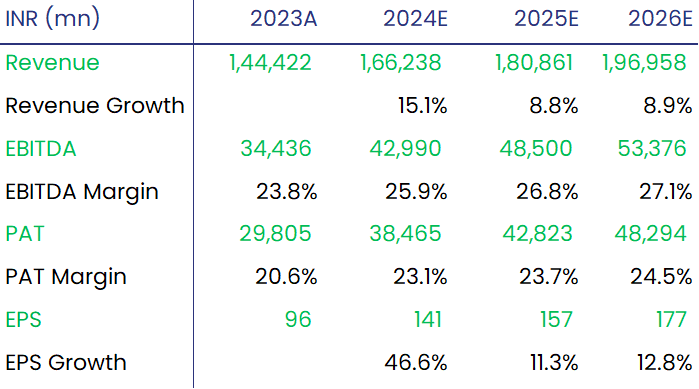

Over the past 5 years, Eicher Motors has delivered a robust financial performance, with its FY23 revenue at INR 14,442 Cr growing at a CAGR of 12% and its net profit at INR 2,914 Cr which expanded at a CAGR of 15%.

The company's flagship Royal Enfield brand has been a key driver of growth, with its sales volumes increasing from ~670,000 units in FY2018 to over 920,000 units in FY2023.

Eicher Motors' EBITDA margin has consistently remained above 25% during FY2018-23, highlighting the strong profitability of its business model.

Industry Outlook

Eicher Motors expects the domestic India premium motorcycling market to reach 2 million units by 2030 vs 1 million units today, representing volume growth potential in this category of 10%+ CAGR.

Goldman Sachs expects premium 250cc+ motorcycles to form ~41% of India's 2-wheeler industry profit pool by FY2028E, up from 27% currently.

Export sales are most accretive to overall ASP for Royal Enfield vs other listed motorcycle companies in India, as their motorcycles sell in more developed markets vs peers which sell into emerging markets.

The India Commercial Vehicles Market size is estimated at $48.2 billion in 2024, and is expected to reach ~$63 billion by 2029, growing at a healthy CAGR.

Peer Analysis

Royal Enfield distinguishes itself with an Average Selling Price ~3x higher than that of its peers like Hero, Bajaj, or TVS Motor, underscoring its premium positioning within the motorcycle market.

As of the end of Q3FY23, Eicher Motors boasts an industry-leading EBITDA margin of over 26%, making it the most profitable auto OEM in India and the third most profitable auto OEM globally, trailing only behind luxury automotive giants Ferrari and Porsche.

Key Drivers and Investment Thesis

The Bullet and Himalayan models lead sales, with the latter's demand spurring a price increase of 15% post its November launch. The Hunter model's introduction, with new color variants, is specifically targeting and successfully attracting a younger demographic.

Inventory levels are efficiently maintained within a 15-30 day range. High-demand models like the Himalayan, Super Meteor, and 650cc twins exhibit waiting periods of 1.5-3 months, indicating strong consumer interest.

Despite the presence of global competitors like Harley and Triumph, Royal Enfield's diversified portfolio across eight brands and its expansive retail network of 2,007 touchpoints, especially in semi-urban areas, solidify its market dominance.

Exports, despite an expected ~28% YoY drop in FY2024 due to macroeconomic challenges, have a substantial growth runway with the mid-size motorcycle market overseas being over 1 million units, where Royal Enfield has a 10% market share.

Investment in EV technology is underscored by the acquisition of a 10.35% equity stake in Stark Future for Euro 50 million, and the development of an EV prototype highlights Royal Enfield's commitment to future mobility solutions.

The dealer network includes 911 studios and 1,096 large stores in India, with an international footprint of 838 MBOs and 221 exclusive stores, supporting healthy retail growth and customer engagement.

Volume growth for Domestic/Exports/Total is projected at CAGR 9.5%/-1.5%/8.3% from FY2023-FY26e. Royal Enfield's market share in the >125cc and >250cc segments stood at 30.5% and 8.1%, respectively, as of 9MFY24, demonstrating strong brand presence and consumer loyalty.

Valuation and Recommendation

We see FY26 EPS at INR 177 and assign a multiple of 28x. We anticipate a target price of INR 4,956, which implies a 14% upside within the next 12 months.

Disclaimer:

Mool Capital Limited is a SEBI Registered Research Analyst having registration no. INH000012449. This report has been prepared by Mool Capital Pvt. Ltd. and is solely for information of the recipient only. The report must not be used as a singular basis of any investment decision. The views herein are of a general nature and do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing. This document is not, and should not, be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report should not be construed as an invitation or solicitation to do business with Mool Capital. Mool Capital and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.